You can choose to register/form your LLC in any U.S. state, regardless of your location, but it is generally recommended to file in the same state that you plan on doing business in.

Your name has to be unique to avoid confusion with an existing registered company within your state. It must contain the words LLC or limited liability company in the name, and you can’t use financial words such as insurance, trust, bank, and inc.

The most essential step towards registering your business is filing the Articles of Organization with your state. Some states use different terminology, such as a Certificate of Formation or a Certificate of Organization.

A registered agent is an individual who will receive legal and other documents on behalf of your business, such as subpoenas, regulatory and tax notices, and correspondence.

An operating agreement records your LLC’s setup and organizational structure. Most states don’t require an LLC to file an operating agreement but most banks and lenders will require one before opening an account or funding your business.

An Employer Identification Number (EIN) is used to identify a business entity. It’s a 9-digit number assigned by the IRS to identify taxpayers who are required to file business tax returns.

Your state determines your annual compliance items, tax filing, license, and permit requirements. You’ll find what you need on the sba.gov website or by contacting your secretary of state’s office.

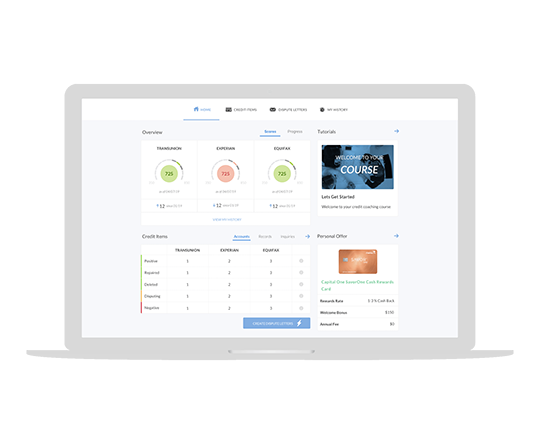

Repair Your credit with MyCrediBreezeDisputes